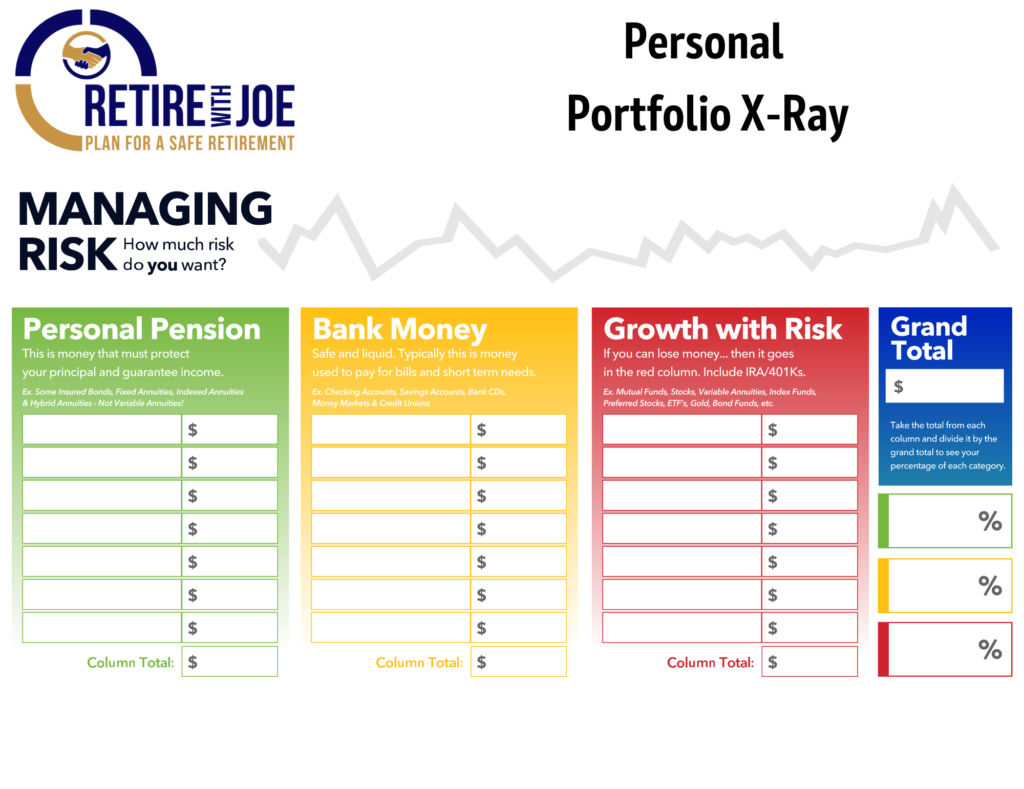

Personal Portfolio X-Ray

The Portfolio X-Ray is a simple and easy way to make sure your finances are balanced and diversified properly for your lifestyle. Forget all the complexities that normal financial advisors bring to discuss risk tolerance and portfolio diversification percentages. The Portfolio X-Ray gives our clients an easy to understand breakdown, not just of their portfolio, but of their overall financial picture. As our clients shift from the ACCUMULATION phase to the DISTRIBUTION phase they need to also shift their portfolio from high-risk growth investments (Red Bucket) to a safe and guaranteed income (Green Bucket).

What is the "Red" Bucket?

The “Red” bucket is also known as the risk bucket. Anything that has RISK and the potential to lose principal is going to be allocated to the red bucket. This bucket consists of stocks, bonds, mutual funds, index funds, IRA’s, 401ks, etc. If it has the potential to lose money, then it goes in the “Red” bucket. The red bucket is most commonly used for clients that are in the accumulation phase, their risk tolerance allows them to take on higher risk in hopes for a higher gain. As clients are getting closer to retirement (within 5 years), they need to start to shift their money from the “Red” bucket and into the “Yellow” or “Green” bucket.

What is the "Yellow" Bucket?

The “Yellow” bucket is referred to as the liquidity bucket. This bucket is going to consists on monies that are 100% liquid and available to use for short term needs or to pay bills. It’s safe and is principal protected because it is usually in a checking or savings account, CD, money market account, etc. We refer to this bucket as emergency money, if something were to break or a disaster were to happen you would have access to the money right away. Typically, you want to have 1 year’s worth of accessible cash here incase there was a need to access it readily. However, having too much money in the “Yellow” bucket can be an issue because its usually not growing at a high enough rate to keep up with the rate of inflation. We call that “going broke… safely”, so its important to allocate the right percentage to this bucket.

What is the "Green" Bucket?

The “Green” bucket is referred to as the safe money bucket. A lot of our clients, prior to talking to us, are not aware that there is a “Green” bucket. This bucket consists of products that are 100% principal protected and can also obtain gains through market participation. Products that are in this bucket usually consists of fixed indexed annuities. With monies in this bucket they can still participate in market gains, but have no risk of losing principal. One may ask, “how can that be?”… It’s really a simple answer. When there is a market gain (positive return), this bucket does not receive the full market gain, it is usually receives a percentage of the market gain. However ,when there is a market loss (negative return), this bucket does not receive a loss, it gets capped at 0. The account stays the same, even though the market produced a negative return. Essentially, the “Green” bucket allows our clients to participate in the positive returns without the risk of taking on negative returns. This is extremely important for clients that are nearing retirement and in the distribution phase, it allows them to avoid market losses so they do not have to worry about losing significant retirement money in a market downturn. It is the one product that offers guarantees and certainty to an individual in their retirement years and should be apart of everyone’s overall financial picture.